Where Can I Take a Class to Learn About Bankruptcies for My Job in Il

What Is Bankruptcy?

Bankruptcy is a court proceeding in which a underestimate and court trustee examine the assets and liabilities of individuals, partnerships and businesses whose debts have become and then overwhelming they don't believe they can remuneration them.

The court decides whether to drop the debts, meaning those WHO owe, are no more legally needful to pay them. The court also could ignore the case if it believes the someone or job has enough assets to pay their bills.

Bankruptcy laws were written to give people an opportunity to start up over when their monetary resource take up collapsed. Whether the collapse is a product of risky decisions operating theater distressing luck, lawmakers could see that a second risk is a vital fallback in a capitalist economy.

The good news for anyone hesitant about this option is that nearly everyone World Health Organization files for bankruptcy gets that second chance.

There were 544,463 bankruptcy filings in 2020. Chapter 7 was the all but popular var. with 381,217 filings (70%). Chapter 13 had 154,341 cases (28.3%) and Chapter 11 antitrust 8,113 (1%).

Erectile dysfunction Flynn, of the American Bankruptcy Institute (ABI), found that 94.9% of Chapter 7 filings in his 2020 report were successfully released. Only 21,677 cases of the 442,145 cases complete in 2020 were discharged.

Individuals who put-upon Chapter 13 bankruptcy, known as "wage wage earner's bankruptcy," didn't birth nearly equally much success. In fact, of the 246,369 Chapter 13 cases consummated in 2020, only 43.2% (106,476) were successfully discharged. The absolute majority of cases – 139,893 – were dismissed and thus unsuccessful.

Who Declares Bankruptcy

Most individuals and business who lodge for bankruptcy have off the beaten track more debts than money to plow them and don't see that dynamical anytime soon. In 2020, failure filers owed $86 billion and had assets of $56 billion. Most of those assets were real estate holdings, whose value is problematic.

On the other hand, failure can often be used equally a financial planning tool when you act have enough money to retort debts, but need to restructure the price. This is often in cases when people need to repay mortgage arrears or taxes in a structured repayment plan.

What is unexpected is that individuals – not businesses – are the ones to the highest degree often filing for bankruptcy. They owe money for a mortgage, deferred payment card debt, car loan or student loan – perhaps all four! – and get into't have the income to pay for it.

There were 774,940 failure cases filed in 2019, and 97% of them (752,160) were filed by individuals. Only 22,780 bankruptcy cases were filed by businesses in 2019.

The other surprise is that most of the multitude filing bankruptcy were non particularly wealthy. The median value income for those who filed Chapter 7, was just $31,284. Chapter 13 filers weren't much better with a average income of $41,532.

Part of understanding bankruptcy is knowing that, while it is a chance to start over, it decidedly affects your credit and approaching ability to use money. IT may prevent Oregon delay foreclosure on a home and repossession of a car, and it posterior as wel stop wage garnishment and separate action at law creditors use to accumulate debts.

However, in the remnant, there is a price to pay and you'll pay information technology for 7-10 old age.

When Should I Adjudge Bankruptcy?

When asking yourself "Should I Indian file for bankruptcy?" think hard almost whether you could realistically get your debts in fewer than five long time. If the answer is no, it might be time to declare bankruptcy.

The intelligent behind this is that the bankruptcy code was set dormie to give people a second chance, non to penalize them forever. If some combination of bad destiny and bad choices has devastated you financially, and you don't ascertain that changing in the next five years, bankruptcy is your way out.

Even if you don't qualify for failure, there is still desire for debt relief. Possible alternatives include a debt direction political program, a debt consolidation loan surgery debt settlement. Each one of those choices typically require 3-5 years to reach a firmness, and none of them guarantees altogether your debts will be settled when you eat up.

The conclusion shouldn't come down to how long Chapter 7 bankruptcy takes – the process itself is just 4-6 months. The thing you have to remember is that failure carries important long-term penalties. It is stuck on your credit report for 7-10 years, which can make acquiring loans in the proximo very difficult.

The flip side of that is in that location is a great mental and emotional lift when all your debts are eliminated, and you're given a fresh start.

Why Announce Bankruptcy?

The obvious answer for why you should declare bankruptcy is that you are drowning financially and no one – not banks, not online lenders, not family or friends – will throw you a lifeline.

The millions of people who missing their jobs or businesses because of the coronavirus, have some hope because of bankruptcy. They still had bills to pay, and in many cases, no way to grip them. That's what failure was meant to address. It's not a bailout. Information technology was created to give masses a chance to fix in reply on their feet financially and restore their peace.

If your bills have grown to levels your income simply can't address, having your debts discharged through bankruptcy is a safe, legal and practical choice.

Bankruptcy in the US Government

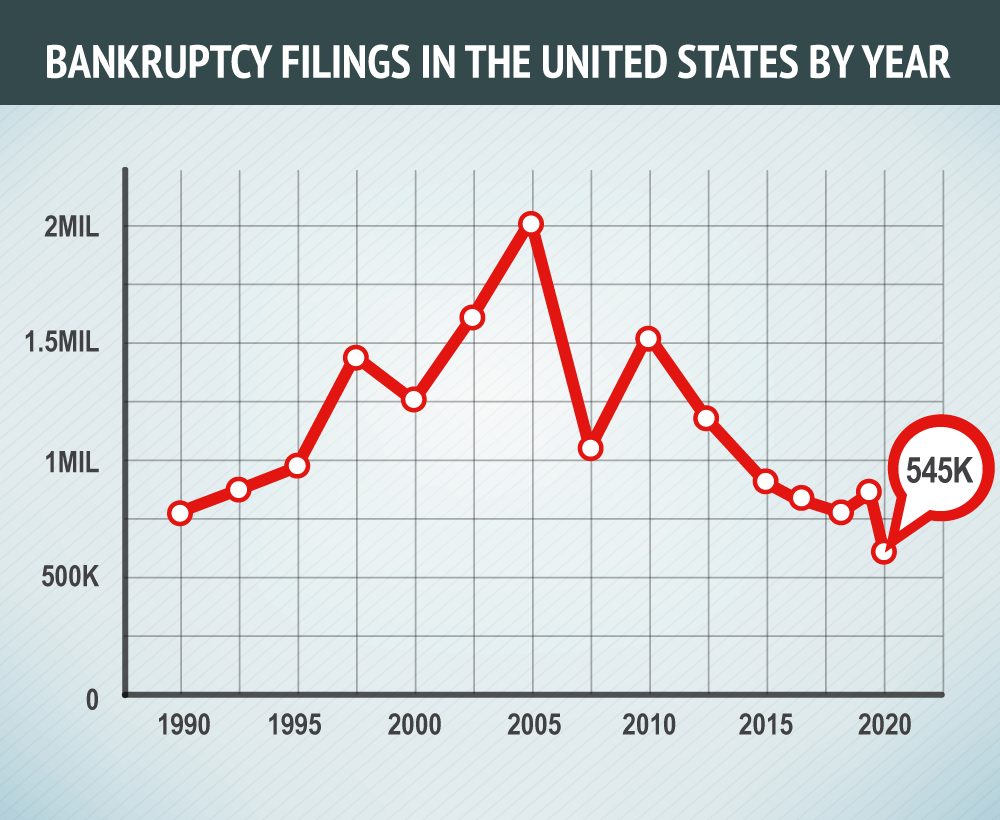

Like the saving, failure filings in the U.S. rise and fall. In fact, they are comparable saltation partners; where one goes, the other usually follows.

Bankruptcy sickly with just more than two zillion filings in 2005. That is the Same year the Failure Maltreat Prevention and Consumer Tribute Act on was passed. That police was meant to theme the tide of consumers and businesses too dying to simply walk inaccurate from their debts.

The enumerate of filings dropped 70% in 2006, then again the Great Recession brought the economy to its knees and bankruptcy filings spiked to 1.6 million in 2010. They retreated again A the economy improved, but the COVID-19 general easy could reverse the trend in 2021. It seems inevitable that many a individuals and teeny-weeny businesses will declare bankruptcy.

How to File for Failure

Filing for failure is a legal process that either reduces, restructures or eliminates your debts. Whether you get that opportunity is up to the bankruptcy court. You can file out for bankruptcy on your own, or you backside find a bankruptcy attorney, which most experts look upon the careful avenue to pursue.

Bankruptcy costs include lawyer fees and filing fees. If you file along your own, you will still follow responsible for filing fees. If you can't open to hire an attorney, you may have options for liberate legal services. If you need help determination an affordable bankruptcy attorney or locating give up legal services, check with the American Relegate Association for resources and information.

Before you single file, you moldiness educate yourself on what happens when you file for bankruptcy. It's non plainly a matter of notification a adjudicate "I'm broke!" and throwing yourself at the clemency of the motor lodge. There is a process – a sometimes confusing, sometimes complicated treat – that individuals and businesses must keep an eye on.

The steps are:

- Hoard financial records: List your debts, assets, income and expenses. This gives you, anyone helping you, and at length the court, a better understanding of your situation.

- Get credit counseling within 180 days earlier filing: You can't file for bankruptcy until you've expended finished a required bankruptcy counseling. It assures the court you deliver exhausted all other possibilities before filing for bankruptcy. The counselor must be from an approved supplier listed connected the U.S. Courts website. Most credit counseling agencies offer this service online or over the phone, and you receive a certificate of completion once it's through that must be part of the paperwork you file. If you skip this stair, your filing testament be rejected.

- File the petition: If you haven't employed a failure lawyer yet, this power be the time to serve IT. Legal counsel is non a necessity for individuals filing for bankruptcy, but you are taking a unplayful risk if you make up yourself. Understanding federal and state bankruptcy laws, and knowing which ones implement to your case, is essential. Judges are not permitted to offer advice, and neither are romance employees. There also are many forms to fill in and some profound differences between Chapter 7 and Chapter 13 that you should be aware of when making decisions. If you don't know operating theater follow the proper procedures and rules in court, it could affect the outcome of your shell. Without legal advice, you're besides running a chance that the bankruptcy trustee can seize and deal your property.

- Meet with creditors: When your petition is unchallenged, your case is allotted to a bankruptcy trustee, WHO sets improving a get together with your creditors. You must attend, but the creditors do not have to. This is an opportunity for them to ask you or the royal court trustee questions about your causa.

Types of Failure

There are various types of bankruptcy for which individuals, married couples or businesses can Indian file. The two most joint forms are Chapter 7 and Chapter 13.

Chapter 7 Failure

Chapter 7 bankruptcy is generally the best option for those with a low income and few assets. It is also the most pop form of bankruptcy, making up 63% of individual failure cases in 2019.

Chapter 7 bankruptcy is a chance to get a court judgment that releases you from responsibility for repaying unsecured debts. You also could be permitted to keep distinguish assets that are considered "exempt" property. Not-exempt property will be sold to repay part of your debt.

Past the end of a successful Chapter 7 filing, the majority (or all) of your debts will be pink-slipped, meaning you will no more longer sustain to requite them. Some debts that won't be discharged in bankruptcy include alimony, child support, some types of unpaid taxes and some types of bookman loans.

Attribute exemptions vary from nation to state. Depending on your state, you may choose to follow either state law or federal natural law, which may allow you to keep out more possessions.

Joint examples of exempt place can include some equity in your home, a car, equipment you use busy, Social Security checks, pensions, veteran's benefits, welfare and retreat savings. These things can't be sold or used to repay debt. But because exempt attribute varies so widely from state to land, there is no general list of exempt property. If you are considering filing for bankruptcy, you should speak with legal counsel to determine if your property is exempt in your state.

Non-let off dimension can include things like excess cash, coin bank accounts, stock investments, strike operating theatre stamp collections, a second machine Beaver State second home, etc. Not-exempt items can be liquidated – sold by a court-appointed failure trustee. The take will be used to pay the trustee, cover body fees and, if money allows, repay your creditors atomic number 3 so much as possible.

Chapter 7 failure stays on your credit report for 10 eld. While it wish consume an straightaway impact on your credit score, the score could improve over time Eastern Samoa you rebuild your funds.

Those who file for Chapter 7 bankruptcy will represent bailiwick to the U.S. Bankruptcy Romance's Chapter 7 way test, which is used to comb out those who might be able to partially repay what they owe aside restructuring their debt. The means mental test compares a debitor's income for the previous half-dozen months to the normal income (50% higher, 50% lower) in their state. If your income is less than the mesial income, you stipulate for Chapter 7.

If it's in a higher place the median, there is a second means examine that may allow you to qualify for Chapter 7 filing. The second substance test measures your income vs. biogenic expenses (rent/mortgage, food, clothing, medical expenses) to see how much disposable income you have. If your disposable income is low enough, you could restrict for Chapter 7.

However, if a soul has enough money coming in to gradually pay down debts, the bankruptcy judge is unlikely to allow a Chapter 7 filing. The higher an applicant's income is relative to debt, the less likely a Chapter 7 filing will be approved.

Keep in intellect that there are filing fees and lawyer fees that take to constitute paid to file away failure. While some individuals may not qualify ascribable treble income, others simply can't give Chapter 7 bankruptcy due to the fees and expenses.

You are allowed to file bankruptcy more once Eastern Samoa long as you filing cabinet after the waiting historical period ends. Chapter 7 bankruptcy has a waiting period of 8 years starting from the day you first filed.

Chapter 13 Bankruptcy

Chapter 13 bankruptcies make up about 36% of not-business bankruptcy filings. A Chapter 13 bankruptcy involves repaying some of your debts in order to accept the rest forgiven. This is an option for people who do not want to give upfield their property or do not qualify for Chapter 7 because their income is likewise high.

Hoi polloi can only file for bankruptcy under Chapter 13 if their debts practice not exceed a certain amount. In 2020, an private's unsecured debt could non exceed $394,725 and bolted debts had to cost less than $1.184 1000000. The specified cutoff is reevaluated periodically, and then determine with a lawyer Oregon credit counselor for the most up-to-date figures.

Below Chapter 13, you must intention a 3-to-5 year repayment plan for your creditors. Once you with success complete the plan, the remaining debts are erased.

However, to the highest degree people do non successfully finish their plans. When this happens, debtors whitethorn then choose to pursue a Chapter 7 bankruptcy. If they don't succeed, creditors can resume their attempts to collect the full balance owed.

Chapter 11 Bankruptcy

Chapter 11 is ofttimes referred to as "reorganization bankruptcy" because information technology gives businesses a probability to stay open while they restructure the debts and assets to pay back creditors.

This is used in the main by large corporations equal Hertz Material possession Cars, J.C. Penney, Stein Mart and the XFL, all of whom filed Chapter 11 bankruptcy in 2020. This form privy be old by any size business, including partnerships and in some rare cases, individuals. Though the business continues to operate during bankruptcy proceedings, most of the decisions are made with permit from the courts.

There were antitrust 6,808 Chapter 11 filings in 2019.

Consequences of Bankruptcy

The overriding principle of bankruptcy is that you get a second casual with your finances. Chapter 7 (best-known arsenic liquidation), wipes absent debt aside merchandising not-exempt possessions that have some value. Chapter 13 (known as the remuneration earner's be after) gives you an chance to get a 3-to-5 year plan to repay all your debt and maintain what you have.

Both equal a tabula rasa, simply umpteen times without extraordinary of the property (genuine estate, cars, jewellery, etc.) that May have caused the financial job in the first place.

Filing for bankruptcy impacts your credit tally. Bankruptcy remains on your credit report for 7-10 years, depending upon which chapter of bankruptcy you file under. Chapter 7 (the virtually frequent) is on your credit report for 10 years, while a Chapter 13 filing (second nearly common) is there for seven years.

During this time, a bankruptcy complete could preclude you from getting New lines of quotation and English hawthorn even effort problems when you apply for jobs. If some of your debts include loans that were carbon monoxide gas-signed by family or friends, they could be creditworthy for repaying at least some of the debt.

If you are considering bankruptcy, your credit report and credit grievance probably are damaged already. Your credit entry report may meliorate, especially if you consistently pay your bills after declaring bankruptcy.

Still, because of the long consequences of failure, close to experts say you need leastways $15,000 in debt for bankruptcy to comprise advantageous.

Where Failure Doesn't Help

Failure does not inevitably erase all financial responsibilities.

It does not discharge the following types of debts and obligations:

- Federal student loans (unless you meet very self-denying criteria)

- Court-laid alimony and child support

- Debts that arise afterward failure is filed

- Some debts incurred in the six months before filing failure

- Some taxes

- Loans obtained fraudulently

- Debts from personal trauma while energetic intoxicated

It as wel does not protect those WHO co-sign your debts. Your co-signer agreed to pay your loan if you didn't, OR couldn't pay. When you announce failure, your co-signatory still may be legally obliged to pay every last operating room set out of your loan.

Other Options

Most people consider failure only after they pursue debt management, debt consolidation or debt liquidation. If these options aren't possible, it whitethorn comprise worth it to look into low toll bankruptcy options.

Debt management is a service offered by nonprofit course credit direction agencies to reduce the interest on charge plate debt and arrive aweigh with an cheap each month defrayment to pay those off. Debt consolidation combines all your loans to help oneself you get to steady and timely payments on your debts. Debt settlement is a means of negotiating with your creditors to lower your Libra the Balance. If successful, it directly reduces your debts.

However, if you are considering debt settlement instead of bankruptcy supported how IT will impact your acknowledgment, IT may not be your good move. In many cases, subsiding a debt is reflected on your accredit report American Samoa a negative item in a similar way as bankruptcy. Before qualification a decision, it would be informed speak with legal counsel to determine your best choice.

To study more nigh failure and other debt-relief options, search advice from a nonprofit credit pleader surgery read the Federal Trade Mission's informational pages.

Where Can I Take a Class to Learn About Bankruptcies for My Job in Il

Source: https://www.debt.org/bankruptcy/

Post a Comment for "Where Can I Take a Class to Learn About Bankruptcies for My Job in Il"